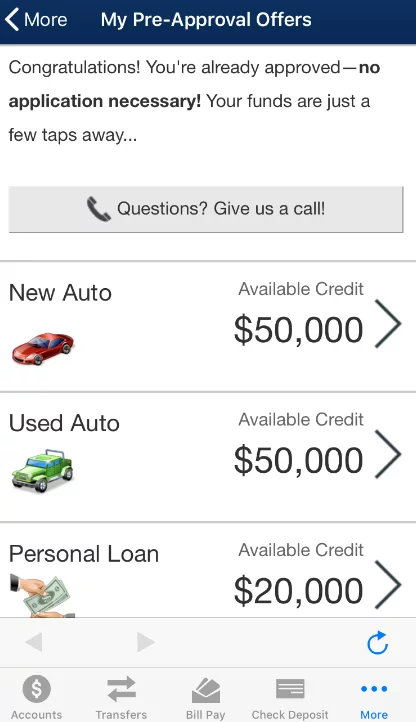

Pre-Approval Offers

One of the simplest ways to get started with a loan to finance what you need is a pre-approval offer*.

The best part about a pre-approval is no application is required to fill out! Your application is already in the system based on your financial eligibility. You’ll save yourself some time from filling out forms.

Your pre-approval offers show you what loans (vehicle, credit card, signature, personal line of credit, and/or home equity line of credit) you’re approved for and up to how much you’re approved for. With an offer, you’re able to purchase that car, new computer, or home project with your approved funds.

Follow these quick steps:

- Select the offer that you want.

- Enter the amount that you want up to the approved limit.

- You’ll see your rate, and what the payment amount will be.

- Read all of the disclosures.

- Submit.

*Not all members will qualify for a pre-approved offer of credit.

Tutorial Video:

PRESCREEN & OPT-OUT NOTICE

This “prescreened” offer of credit is based on information in your credit report indicating that you meet certain criteria. This offer is not guaranteed if you do not meet our criteria (including providing acceptable property as collateral). If you do not want to receive prescreened offers of credit from this and other companies, call 1-888-567-8688 or visit the website at www.optoutprescreen; or write:

TransUnion Name Removal Option P.O. Box 505, Woodlyn, PA 19094-0505

Equifax Information Services LLC, P.O. Box 740123, Atlanta, GA 30374-0123

Experian Opt Out, P.O. Box 919, Allen, TX 75013-0919

Innovis Consumer Assistance, P.O. Box 495, Pittsburgh, PA 15230-0495

Online & Mobile Banking

Quick Links

Apple Pay – Activate Apple Pay for your Interior Federal Debit and Credit Card.

Visa Secure – Easy, fast and secure. Paying online just got easier with Visa Secure