News & Events

2024 Bring Your Kid to Work Day

On April 25th, we celebrated Bring Your Kid to Work Day at the Main Interior Building! It was an eventful day filled with laughter and learning. We handed out coloring books to the kids and shared information about our Little Buffalo Youth Accounts!

2024 Interior Federal's 89th Anniversary

On April 24th, we celebrated our 89th anniversary! We are grateful for our incredible members and their unwavering support on this journey. Here’s to many more years of serving our members!

2024 Earth Day

Over the weekend, our team gave back to Mother Nature, pulling invasive plants at Rock Creek Conservancy! On Earth Day, we handed out sustainably sourced water in plant-based cartons at the Main Interior Building, and our CEO and Business Development Officer picked up trash at the National Mall. Every action counts in making a greener, cleaner world!

2024 Annual Credit Union Cherry Blossom Race

On April 7th, our staff volunteered at the Annual Credit Union Cherry Blossom 10 Mile Race! With over 17,000 runners gathered at the Washington Monument from all over the world, and more than $11 Million raised for the Children’s Miracle Network Hospital, we love participating at this event every year. It was a rewarding and enjoyable day for our Credit Union as we got to pass out water to the runners as they crossed the finish line.

2024 88th Annual Meeting

On March 20th, we hosted our 88th Annual Meeting watch party! Thank you to everyone who joined us.

2024 LAYC & MMYC Breakfast for Heroes

On March 5th, our Business Development Officer, Stuart attended the LAYC (Latin American Youth Center) & MMYC (Maryland Multicultural Youth Centers) Breakfast for Heroes.

The Annual LAYC Breakfast for Heroes serves as an opportunity highlight to a few standout supporters who have exemplified exceptional commitment to our youth. Each year LAYC serves over 4,000 youth and families through youth centers, school-based sites, and public charter schools in the District of Columbia and Maryland’s Prince George’s and Montgomery Counties.

Pictured below: Stuart with Mirna (Lupi) Quinteros-Grady, President & CEO of LAYC

2024 Wealth Management Seminar

On February 28th, our Wealth Advisor, Mikael Hallstrom, led an informative Wealth Management Seminar at USGS. With his expertise, attendees gained valuable insights into managing their finances effectively and planning for the future.

The seminar was interactive, with participants asking questions and having insightful conversations. Overall, it was a successful event and we’d like to thank everyone who joined.

Interior Federal Recognized as an Inclusive Workplace

January 5, 2024 – Interior Federal is proud to announce that it has been recognized as an “Inclusive Workplace” by Best Companies Group, an independent research firm specializing in identifying and recognizing the best workplaces all around the world, and COLOR Magazine, a leader in corporate inclusivity.

The “Inclusive Workplace” recognition is based on employee feedback gathered through comprehensive surveys and data analysis. Areas of evaluation include inclusion, belonging, psychological safety, community, and purpose. The results from the survey showed the Credit Union’s exemplary commitment to fostering inclusivity and a sense of belonging in our work environments, and those who surpass the data-driven benchmarks are eligible for this prestigious recognition.

“DEI means that we are inclusive of every single person in every facet of our business. We value people, period. People make up an organization, with diversity and uniqueness adding value in a multitude of ways. We’re better because of it,” said Kimberly McCallum, Interior Federal’s Senior Vice President.

Recipients of this recognition have shown significant commitment to ensuring all their employees feel included, heard, and valued. Their commitment to inclusive work environments has had meaningful impacts on employee engagement, retention rates, and brand recognition. The companies recognized this year serve as beacons of inclusive culture within their respective industries, demonstrating the immense benefits of prioritizing belonging and inclusivity in the workplace.

To review the full list of winners, visit the link here.

2023 International Credit Union Day

Credit unions worldwide joined in the celebration of the 75th anniversary of International Credit Union Day on October 19th. This significant day is dedicated to commemorating the rich history of the credit union movement, highlighting its accomplishments, acknowledging dedicated efforts, and sharing member experiences.

Interior Federal marked this occasion by setting up informative displays at our branches, showcasing the remarkable benefits and historical significance of credit unions. We engaged in meaningful conversations with our valued members, offering treats and swag. We extend our heartfelt gratitude to each member of our credit union family for their integral role in our journey towards financial empowerment. Your unwavering support is invaluable to us.

2023 NPS Service Awards

Introducing Our New Look!

February 15, 2024 – We are so thrilled to announce our rebrand! Over the past year, we have been busy preparing to bring forth a refreshed look for Interior Federal, one that better aligns with our members and the communities we serve. This rebrand introduces a new name, logo, tagline, core values, mission, vision, and promise statement.

While our appearance may be changing, rest assured that our people and values have not. We are still the same credit union you know and trust, with member satisfaction remaining as our top priority. We are excited to reveal this transformation, marking the beginning of an exciting new chapter in our shared journey!

To delve deeper into the story behind our rebrand, be sure to check out our latest blog post.

2023 4-Star Rating from Bauer Financial

Interior Federal has received a 4 Star Rating from Bauer Financial, an independent, national bank rating firm. A 4 Star Rating is categorized as Excellent, and Bauer recommends our credit union.

Michael Merryman, CEO of Interior Federal says “We’re proud to be recommended by Bauer Financial for our strong performance. Our dedicated staff are passionate about serving our members’ unique financial needs and this recognition affirms our ability to do just that.”

Since 1935, we have served as the official Credit Union for the Department of the Interior’s employees and their families, retirees, contractors, and volunteers. Today, our success enables us to continue serving with great rates, lower fees, convenient digital technology, and exceptional service. We’re excited to grow and evolve with our members’ ever-changing needs while remaining their trusted financial partner.

As a not-for-profit cooperative, our success isn’t just a reflection of our credit union, but also of our valued members. We thank them for choosing Interior Federal as their Natural Resource for Financial Services.

2022 Welcome RCC!!

Interior Federal is so excited to bring the Rock Creek Conservancy into our field of membership! We are pleased to begin offering financial services to their Employees and Board of Directors.

Rock Creek National Park was officially authorized in 1890, making it the third National Park to be designated by the Federal Government. Rock Creek Conservancy (RCC) is a watershed organization protecting Rock Creek and the philanthropic and stewardship partner to the entirety of Rock Creek (National) Park. The Conservancy’s mission is to restore Rock Creek and its parklands as a natural oasis for all people to appreciate and protect.

2022 53rd National Indian Education Association Conference & Tradeshow

Interior Federal staff had a great time celebrating education sovereignty at the 53rd National Indian Education Association conference & tradeshow. Interior Federal supports National Indian Education Association and looks forward to more opportunities like this!

88th Anniversary

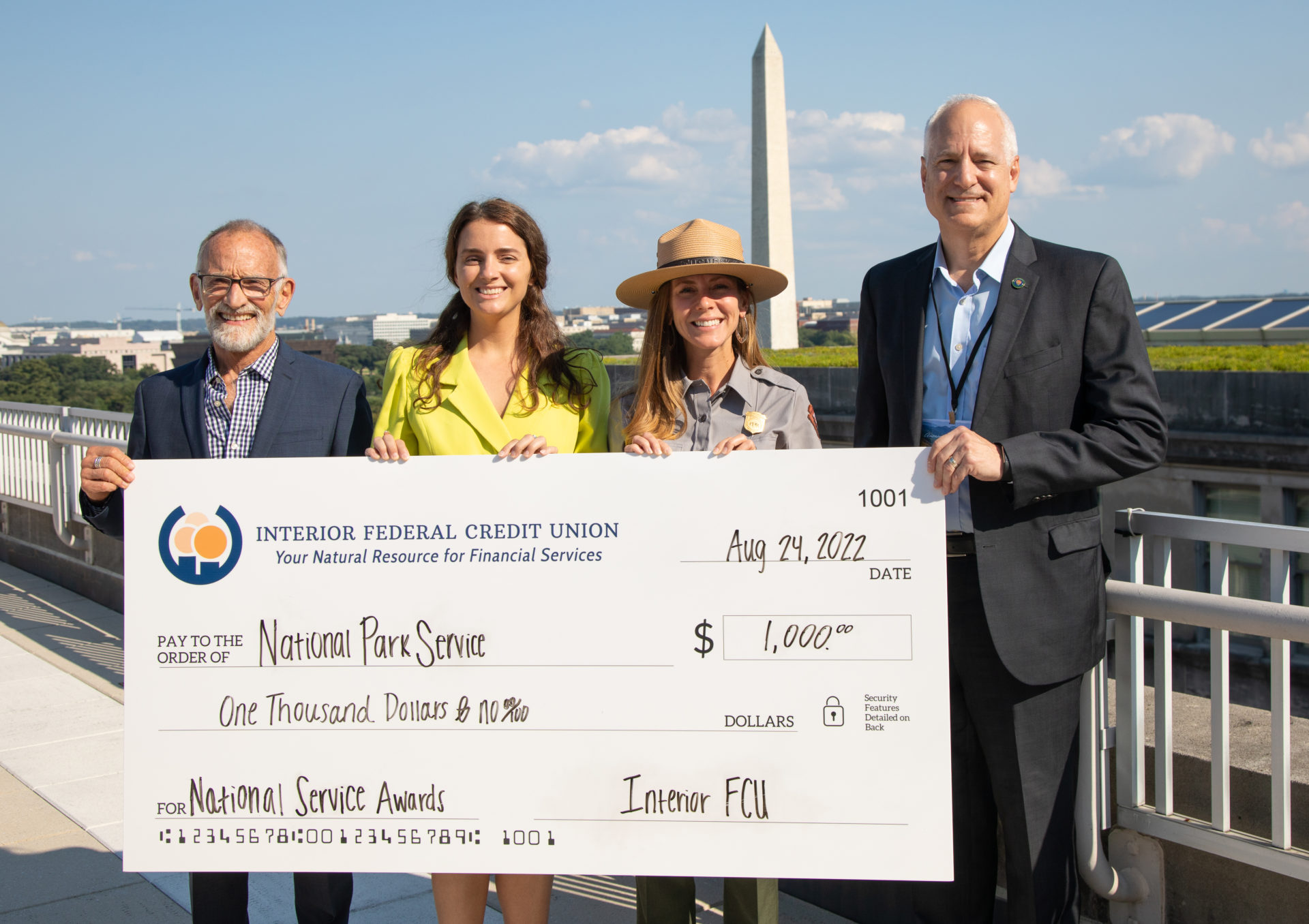

2022 National Park Service Awards Ceremony

August 26, 2022, Interior Federal Staff and Chair of the Board, Mark Davis, attended the 2022 National Park Service Awards Ceremony. Interior Federal was a proud sponsor of the 2022 National Park Service Awards Ceremony.

Click the links below to learn more about the ceremony and awards recipients.

https://www.nps.gov/orgs/1207/08-25-2022-nps-awards.htm

https://www.nationalparks.org/news-and-updates/press-releases/national-park-service-and-national-park-foundation-recognize-outstanding-employees-volunteers-and-partners

2022 Earth Day

Interior Federal staff had a wonderful time celebrating Earth Day at Monocacy Battlefield. This event provided hands on education on how native plants help the environment.

2022 National Public Lands Day

Interior Federal Staff had a great time celebrating National Public Lands Day. This year staff volunteered their time to help preserve Piney Branch Oasis on Rock Creek Park.

2022 National Indian Education Association Hill Week

NIEA Hill Day provides members, educators, and advocates the opportunity to engage with members of Congress in support of NIEA’s legislative agenda for Native Education. The Credit Union was also proud to sponsor the participant packet for the week. We are excited to continue attending and volunteer at more events like this.

2022 Annual Credit Union Cherry Blossom 10 Mile Race & 5k Run/Walk

April 3, 2022, Interior Federal staff volunteered at the Annual Credit Union Cherry Blossom 10 Mile Race & 5k Run/Walk. Each year this event brings Credit Unions together to raise funds for Children’s Miracle Network Hospitals. This year the Department of the Interior Secretary, Deb Haaland gave her remarks at the race kickoff and participated in the 10 Mile Race. We are so happy to be a part of such a wonderful event with an even greater cause.

Read more about the event in MDDCCUA’s Article here.

Jason Putsche Photography

2022 Welcome Back to Work DOI!

In 1935, Interior Federal was designed and created to serve the diverse needs of the Department of the Interior staff. It has been two long years since we have all been together and we couldn’t be more excited to have our DOI family back to work. This week we had so much fun providing DOI staff with a Welcome Back Party. We look forward to more events like this!

2021 Credit Union Cherry Blossom 10 Miler

Interior Federal staff members volunteered at the 2021 Credit Union Cherry Blossom 10 Miler September 12, 2021. The event raised $180,000 to support Children’s Miracle Network Hospitals.

2021 Interior Federal Fundraiser

November 15-December 15, 2021, Interior Federal collected donations to keep our friends outside the Main Interior Building on E St warm. With your help, we were able to donate $823 to Miriam’s Kitchen. Miriam’s Kitchen is a local DC nonprofit working to help the homeless.

2022 Kids Fishing Day

Interior Federal staff enjoyed a beautiful spring morning facilitating Herndon, VA’s Kid’s Fishing Day. The event had a great turn out and many kids were able to catch their first fish. Following the family fun event, the Northern Virginia Chapter of Trout Unlimited met at a local brewery. Interior Federal staff and Chair of the Board, Mark Davis had a great time connecting with Trout Unlimited members and look forward to getting more involved.

86th Annual Meeting

Interior Federal’s 86th Annual Meeting was held on March 16th from 2:00PM – 3:00PM.

2021 International Credit Union Day

On October 21, 2021, Interior Federal will join over 56,000 credit unions around the world to celebrate International Credit Union (ICU) Day. The theme of ICU Day 2021 is “Building financial health for a brighter tomorrow.” ICU Day highlights the many ways that credit unions across the world help members improve their financial health and well-being. Members who stop the branch on ICU Day will be offered a few sweet treats to enjoy. We hope to see you there!

2021 20,000 Members

September 2021, Interior Federal is excited to announce our accomplishment of reaching 20,000 members. Thank you to all of our new and long-term members!

2021 National Public Lands Day

Interior Federal staff celebrated National Public Lands Day volunteering at the Kenilworth Aquatic Gardens.

85th Annual Meeting

The 2021 Annual Meeting will be held virtually March 17, 2021 at 2:00 PM.

2020 Corps Network Conference

This year, we sponsored The Corps Network 2020 Thrive Conference. We are proud to offer membership to Corps members.

2020 GSA Virtual Conference

Interior Federal was a bronze sponsor for the event, which was held October 26-30, 2020. At the conference, our logo was featured in the virtual networking lounge.

2019 Benefits Fair

This year, we attended the Federal Employee Benefits Fair in Sterling, VA and the Main Interior Building.

One of our Member Services Representatives at the Benefits Fair in Sterling, VA.

2019 NACE Employee Appreciation Day

Interior Federal attended the National Capital Parks – East Employee Appreciation Day at Anacostia Park Skating Pavillion.

2019 Geological Society of America

From September 22-26, 2019, Interior Federal attend the Geological Society of America (GSA) Conference in Phoenix, Arizona. At the conference, we brought awareness to thousands of GSA members about being able to join the credit union and its benefits. We gave out tons of giveaways to potential members.

84th Annual Meeting

The 2020 Annual Meeting was held virtually August 19, 2020 at 2:00 PM.

Signup for text alerts for a chance to win a $50 gift card!

KEEP INFORMED! Members can opt-in to receive news and special offers…JUST FOR YOU! Opt-in today by texting “IFCU” to 72000. Members can opt-out by texting “STOP”. SIGN UP AND YOU MAY WIN A $50 GIFT CARD FROM OUR MONTHLY DRAWING.

2019 Great Outdoors Day of Service

On June 14, 2019 Interior Federal participated in the 6th Annual Great Outdoors Day of Service hosted by the Corps Network. This year the event was held at Theodore Roosevelt Island in Washington D.C.

2019 Trout Unlimited Conference

Interior Federal sponsored Fishing Day at the 2019 Trout Unlimited’s Annual Meeting and Conference in Rogers, Arkansas.

Our Vice Chair of our Board in Rogers, AK at the Trout Unlimited Annual Conference.

Our EVP fly fishing with our partner Trout Unlimited at Fishing Day.

Contact Us

We’re never more than a click or call away.

We’re never more than a click or call away.