June 6, 2023

How a Credit Union’s Digital Banking Can Transform Your Finances

Digital banking through your credit union membership can be an incredibly powerful tool for managing your finances. With access to an array of digital services, members enjoy the flexibility and convenience of taking care of their financial needs without ever having to leave the house. Whether you want to manage all your accounts online or make payments on the go, digital banking can help you stay on top of your finances.

What is Digital Banking?

Digital banking refers to the use of online and mobile technology to perform all banking transactions without visiting a brick-and-mortar bank location. With digital banking, members can access their accounts, transfer funds, pay bills, apply for loans, and even make check deposits from their smartphones, tablets, or computers. Digital banking is known for its convenience, speed, and security features. Plus, you don’t have to worry about rushing to the credit union during their operating hours as you can access it 24/7 from anywhere in the world.

What Types of Services are Available Through Digital Banking?

Have you ever found yourself in a situation where you need to transfer funds immediately, but it’s outside banking hours? Or maybe you’ve misplaced your debit card and need to pay a bill ASAP.

In today’s fast-paced world, digital banking has become a necessity for many people. From checking your account balances to paying bills, it offers a wide range of services. But did you know that there are even more services available through digital banking? For starters, you can transfer money between accounts, deposit checks by simply taking a picture with your smartphone, and even pay your friends back using ZelleⓇ, a peer-to-peer payment method.

And let’s not forget the added security measures that come along with it. No worries about lost or stolen cards, as you can freeze your account with just a click of a button.

You can also set up alerts to remind you of upcoming bills or when your account balance is low. Digital banking makes managing your finances easier and more convenient than ever before.

What are the Benefits of Digital Banking?

Banking has come a long way since the days of paper checks and handwritten ledger books. Digital banking allows for increased convenience, flexibility, and security. Digital banking services make it easier than ever for credit union members to manage their finances quickly and efficiently. Let’s take a look at these features in more detail.

Convenience & Flexibility

One of the biggest advantages of digital banking is that it saves time by allowing customers to manage their finances on their schedule. Instead of having to physically go into a bank branch or wait for the mailman to bring your monthly statement, you can access your account information 24/7 from anywhere with an internet connection. You can transfer funds, pay bills, and check your balance, and even access your mortgage account, whenever it’s convenient for you. No more waiting in line!

Additionally, digital banking services allow you to set up alerts so that you always know when a transaction has taken place or when your balance drops below a certain amount.

Security

Another great benefit of digital banking is improved security. Most credit unions are using advanced encryption technology to protect customer data and prevent fraudsters from accessing accounts. Additionally, Interior Federal offers multi-factor authentication which requires members to provide at least two pieces of identification (such as a password and a PIN) before they can access their accounts. This added layer of security provides peace of mind knowing that no one else can access your account without your knowledge or consent.

Learn everything you need to know about secure digital banking in our Guide to Secure Digital Banking.

Easier Access to Services & Information

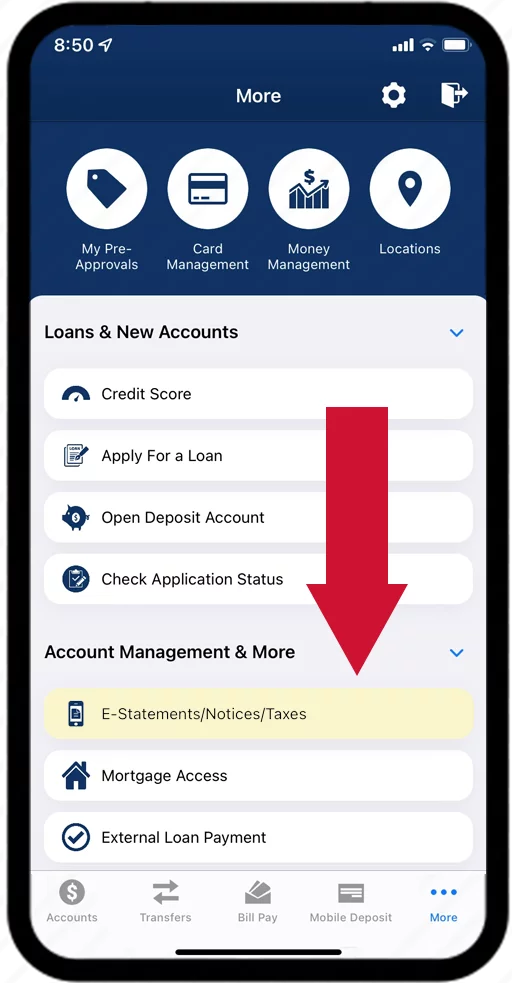

Digital banking also makes it easier for members to take advantage of other services such as applying for loans or signing up for online payment plans. Interior Federal offers helpful tools such as budgeting calculators or investment advice that can help make managing money simpler and more efficient. Plus, with Interior Federal, you’ll also find a mobile app to easily access account information on the go directly from your smartphones or tablets.

Learn more about the Interior Federal mobile app

Utilizing Tools Such As Money Management

Once you are comfortable using mobile banking tools, consider taking advantage of additional tools such as Interior Federal’s Money Management. With features such as transaction categorization, bubble budgeting, and the spending chart, this tool can help make managing your finances easier by providing insights into where your money is going each month as well as helping track spending habits over time. By utilizing Money Management in conjunction with traditional services such as checking/spend accounts and credit cards, members can gain more control over their financial future while still enjoying the convenience of digital banking solutions.

Quick Tips for Managing Finances Using Digital Banking Services

Digital banking services are a great way to manage your finances and stay on top of what’s happening with your money. But if you’re new to digital banking, it can be hard to know where to start. Here are some tips for making the most of your digital banking platform so that you can better manage your finances.

Set Up Notifications

One of the best ways to use digital banking is to set up notifications for important account activity. Customize what type of notifications you receive, from low balance alerts and upcoming payment reminders, to transfer confirmations and more. Being able to monitor your accounts in real-time gives you peace of mind that no fraudulent activity has occurred and helps ensure that all payments are made on time.

Take Advantage of Automated Savings Programs

Most digital banking platforms offer automated savings programs or other features that make saving money easier. These programs allow users to save money without having to think about it. Simply set up a few parameters, such as how much and when you want the money transferred into your savings account, and Interior Federal does the rest! The key is setting up automated transfers. Once you have them in place, you don’t have to worry about manually transferring funds each month.

Apply for Loans, Credit Cards, or Additional Accounts Through Your Digital Banking Platform

Digital banking also offers the ability to apply for loans, credit cards, or additional deposit accounts directly on the digital banking platform. This makes it easy for members as all the information needed is available in your profile, eliminating the need for additional paperwork or lengthy applications.

Digital banking offers numerous advantages over traditional banking. With improved financial stability and control, enhanced customer service and access to more services, increased security and convenience of digital banking options, and greater financial freedom through digital banking tools, Interior Federal’s digital banking can truly transform your finances.

Want more credit union information?

Subscribe to eNews