March 29, 2019

Paperless Budgeting & Trending

Budgeting

Some people may set up their budgets the old-fashion way by writing them down. Interior Federal members utilize paperless budgeting through Money Management. Budgets can help you set realistic monthly spending limits and monitor your progress toward hitting those limits.

The Budgets tab in Money Management is an interactive section that categories your budget and monthly allowance in colorful bubbles. The big bubbles represent a larger portion of your monthly budget, and red bubbles mean you have exceeded your monthly budget allowance that you’ve set for yourself.

Auto-Generate Budgets

When first using the Budgets tab, you will have the option to “Auto-Generate Budgets” or to start from scratch. It’s encouraged to use the auto-generate budgets feature in order to start a budget for yourself based on your average spending over the past 90 days.

There may be some categories that you don’t want included in your budget. You can delete categories of spending that you do and do not want displayed in your budget. If a category was added during auto-generation that you do not want in your budget, you can delete it by clicking on the trash icon to the right of the screen.

As time goes on, your expenses may change. Therefore, you can recalculate your budgets any time. Recalculated budgets are based on your recent transactions in the past 90 days in order to tailor your budgeting to your actual spending.

The size of your bubble represents the budget amount, relative to your overall budget. The larger the bubble, the more of your overall budget that category consumes. The bubble will grow to reflect the percentage the category represents.

To edit a bubble in your budget, click on it to display the budget details. Here, you can click on the pencil icon to edit or delete the selected category, view spending trends in that category and sub-budgets.

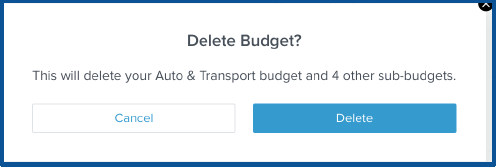

To delete your budget:

- Click on the budget bubble to open the detailed view.

- Click on the pencil icon.

- Click “Delete [budget name]”.

- Click “Delete” again to confirm.

Do you want to include what your budget might look like with your income? You can view and edit your projected income within budgets, helping you to make decisions that balance with your income. Projected income is calculated based on transaction history; however, you can edit this number manually.

To edit projected income:

- Click on the panel in the bottom left corner of the Spending tab.

- Click on the green projected income amount.

- Enter a new amount.

- Click “Save”.

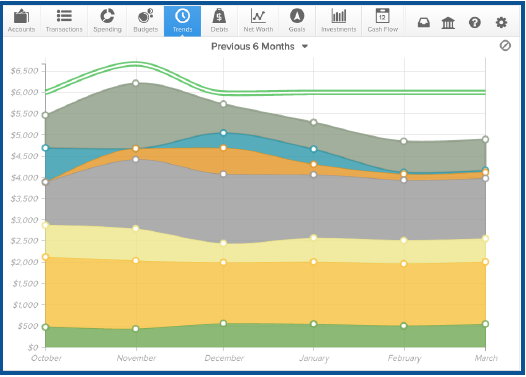

Trends

Another great feature of Money Management is the ability to monitor trends. As months go by, you’ll be able to see how your spending habits have increased and/or decreased. The Trends tab displays up to 12 months of spending by category, along with overall income, represented by the green line. This comparison can help a user quickly determine if they are living within their means. As you hover over any category, you’ll be able to see the total spent in that category at any particular time. Next, click on any category to drill down into a breakdown by sub-category.

Utilizing the bubbles in Money Management and viewing the trends in your spending will help you evaluate your monthly expenses.

Click here to learn more about Money Management.

RELATED: Track Spending – Money Management

Want more credit union information?

Subscribe to eNews