December 13, 2023

What are your Financial Goals?

Goals

“A man without a plan is lost before the day starts.” This quote by Lewis K. Bendele accurately explains what happens without planning your financial goals. We all have wants in life… vacations, a new car, a new home, or anything else that would add new happiness to your life. Planning financial goals will help you plan ahead and visualize long-term financial objectives.

Money Management is a free and user-friendly tool designed to simplify your financial oversight. It brings together all your accounts, both internal and external, presenting a clear overview of your transactions. Within Money Management, the Goals feature will provide a timeline of prioritized goals, and project how long it will take to complete each goal based on your saving plans.

How to Access Money Management

To access Money Management within our mobile banking app:

- Login to our Mobile Banking app.

- Click on the More tab at the bottom of the screen.

- Select Money Management.

Set a Goal

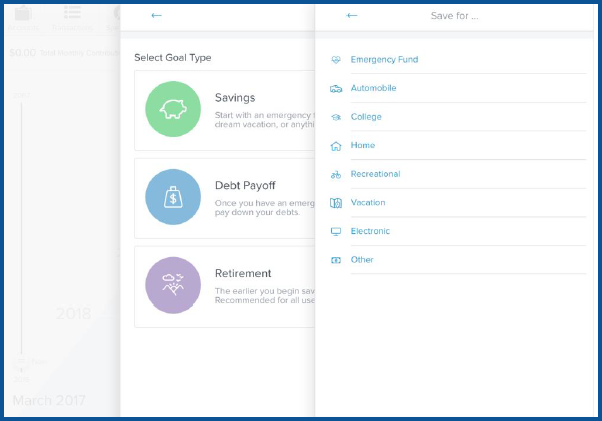

Money Management allows you to set three types of goals: savings, debt payoff, and retirement. One important savings tip, that most people do not do, is set up a savings account for an emergency fund. Saving $1,000 in an emergency-only account is a good start, but working toward 3-6 months of living expenses is a better long-term goal.

Want to start creating your savings goals? Here’s how:

- Click “Add a Goal” at the top right.

- Select the “Savings” goal type.

- Select a specific goal to save for, like “College”, or “Home”

- Customize the goal’s name.

- Specify the amount to save.

- Select an account.

- Save.

Each goal must be tied to its own account – except retirement goals, which may be tied to multiple accounts. This will be used to measure your progress toward each goal. You can choose to open new savings accounts in order to set additional goals.

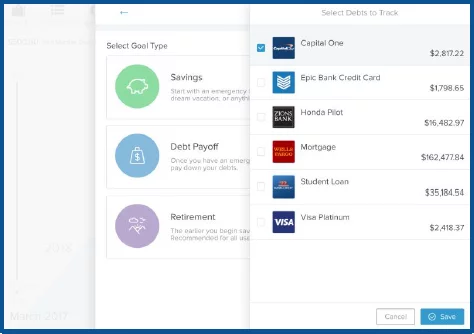

Planning on paying off your debt? Here’s how you can:

- Click “Add a Goal” on the top right.

- Select the “Debt Payoff” goal type.

- Select the debt you’d like to track.

- Save.

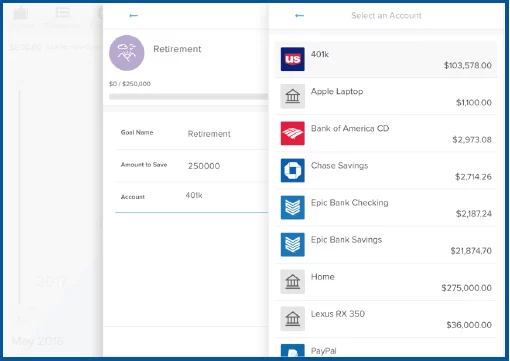

How about saving for retirement? Here’s how:

- Click “Add a Goal” on the top right.

- Select the “Retirement” goal type.

- Specify the amount to save.

- Select all retirement accounts.

- Save.

This tool will show how much you are projected to have by your target retirement age and will let you know if you are not projected to meet your goal on time.

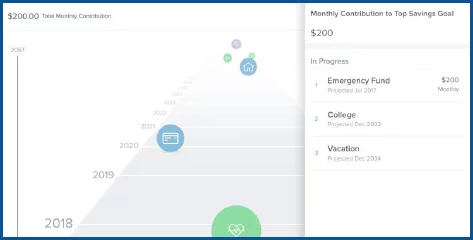

Manage Goals

When creating goals, you’ll need to know how much should be contributed over time. The “Manage” feature gives you the opportunity to see all of your current goals and the total monthly contribution. For savings goals only, you can change the goal priority by dragging the goal up or down on the list.

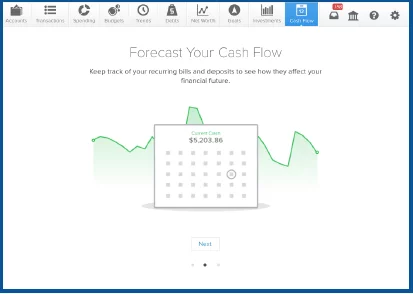

Cash Flow

It’s imperative to know what you’re spending now affects your cash flow in the future. In Money Management, the Cash Flow tab will help you understand historical spending and predict your future spending. This comes in handy when identifying and adding recurring bills and payments, along with one-time or annual payments, such as property tax. How does this help you? It allows you to see the impact of upcoming payments and plan ahead.

When you first open the Cash Flow tool, you’ll be prompted to add regular deposits and payments as “Cash Events”. You’ll be given suggestions based on recurring transactions. Next, you’ll select the green checkmark to accept a suggested event, or the red “X” to reject it. Once adding an event, select the appropriate frequency and save. After you’re done adding events, you be able to see your currently-available cash based on all asset accounts and an estimate of your available balance in the near future.

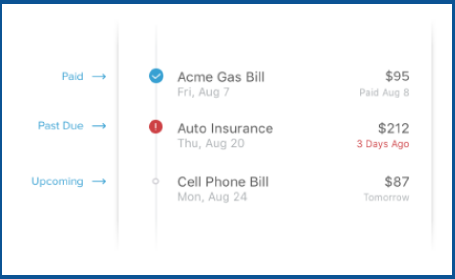

Cash Events

Cash events can be income or expenses – but they will always include the following:

- Payee: Enter the name of the cash event. For example: “Paycheck” or “Mortgage Payment”

- Average Amount: Amount of recurring transaction.

- Type: Specifies whether the event is income or expense.

- Account: Specifies the account in which the event occurs.

- Frequency: Select the date and repeating scheduled for the event.

- Category: Choose the appropriate category for the transaction. (optional)

Paid events will have check marks and overdue events will have a red exclamation mark. If you want to update the status of an overdue event, you can click “Mark as Paid”.

Once you’ve set your financial goals and are sure of what funds are coming in and going out, you’ll be able to plan for future getaways or even the occasional binge shopping spree!

RELATED: Debts & Net Worth

Want more credit union information?

Subscribe to eNews