August 22, 2023

How Digital Spend Account Dividends Work

Want to earn the highest dividend possible on a Checking Account? Look no further with the Digital Spend Account, coming soon to Interior Federal!

When you have a Digital Spend Account, you qualify for dividends as follows:

- If you meet the 4 qualifications, you will earn the going rate on amounts up to $10,000 (currently 3% dividend rate), then .50% on balances $10,000 +.

- If you don’t meet the 4 qualifications, you will earn .05% on all balances.

To be eligible for the highest dividends, members must meet the 4 qualifications during the qualification month, which is the month prior. For example, for June dividends (paid on July 1st), the qualification period is May. If members met the qualifications in May, then the dividends paid out on July 1st for balances in June would be at the highest rate. If not, then members would get the lower dividend rate.

The 4 monthly qualifications are:

- Monthly Direct Deposit into our new Digital Spend Account of $1,000 or more.

- Complete at least 12 monthly transactions on our debit and/or credit card.

- Login to your digital banking account monthly.

- Complete at least 2 digital wallet transactions (using one of our 5 digital wallets) monthly with our debit and/or credit card.

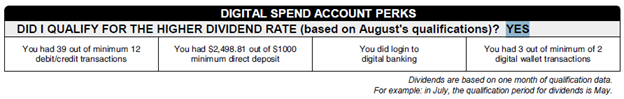

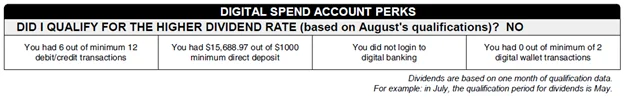

Your statement will look something like this:

“DID I QUALIFY FOR THE HIGHER DIVIDEND RATE (based on August’s qualifications)?”

- The disclosure “based on August’s qualifications” refers to all the transactions that you completed in the month of August. Your August qualifications will determine what dividends you will receive for the month of September. On October 1st, you will receive the dividends for September, along with the statement listing August qualifications.

- Section 1: “You had ‘X’ out of a minimum of 12 debit/credit transactions”. Even though the Digital Spend Account is replacing the checking account, we recognize not everyone only uses a debit card when making purchases. You can use a combination of both your Interior Federal debit OR credit cards to reach the 12 minimum transactions in a month.

- Section 2: “You had ‘$XX.XX’ out of $1000 minimum direct deposit”. If you need help setting up your direct deposit, we have resources for you!

- Section 3: “You did/did not login to digital banking”. Since almost 99% of our members never visit a branch in person, we have invested in technology to make their digital experience pleasant. Check out our 4.8 star rated mobile app or login on a computer to access your accounts any time or anywhere.

- Section 4: “You had ‘X’ out of a minimum of 2 digital wallet transactions”. Digital wallets are quickly becoming the norm of payment types. Think about it, no more digging for your physical wallet, forgetting your card at home, or trying to pay online and typing in your card number. Digital wallets make those inconveniences a thing of the past! Watch our video or webinar on how to add your Interior Federal debit and/or credit card to a digital wallet, or read our blogs on how to use them! Making two transactions per month is easy. Pay for your groceries, gas, and/or a cup of coffee with your digital wallet and you’ve already surpassed the minimum number you need to qualify! We think that once you try it, you’ll never go back! 😊

We want to reward our loyal members with high dividends in exchange for making Interior Federal your primary financial institution. Check back for more updates and information on the new Digital Spend Account coming soon.

Related Content: Earn Loyalty Rewards

Want more credit union information?

Subscribe to eNews