July 1, 2019

Who Do I Owe and How Much Am I Worth?

Debts

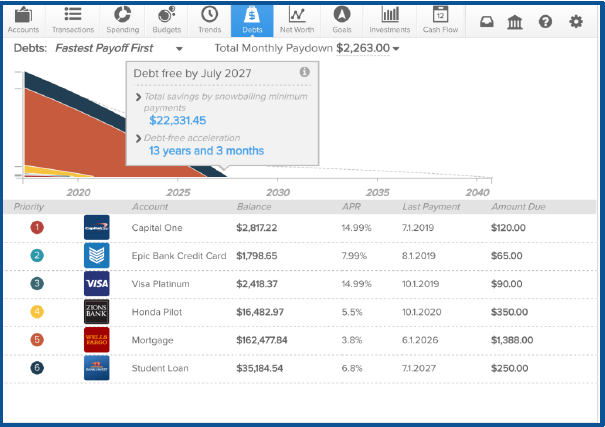

Having debt on your plate is inevitable. Therefore, it’s important to track down how much you owe and who you owe. The Debts tab of Money Management is a powerful tool that allows you to see all your debts in one place, create an payoff plan, and calculate the time and money to be saved by using the debt snowball strategy.

The dotted line that extends to the far right of the chart represents the status quo – how long it will take to get out of debt by making minimum payments and without rolling over payments.

The dotted line that extends to the far right of the chart represents the status quo – how long it will take to get out of debt by making minimum payments and without rolling over payments.

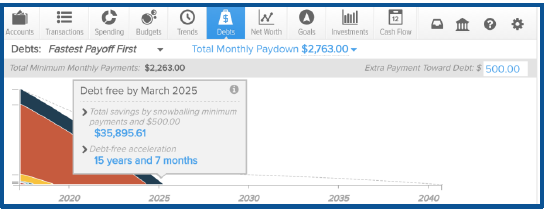

The colorful graph above represents the payoff for all of your debt. By hovering your mouse over the graph, you’l be able to see how much total debt you will owe at any future point in time, based on the current projection.

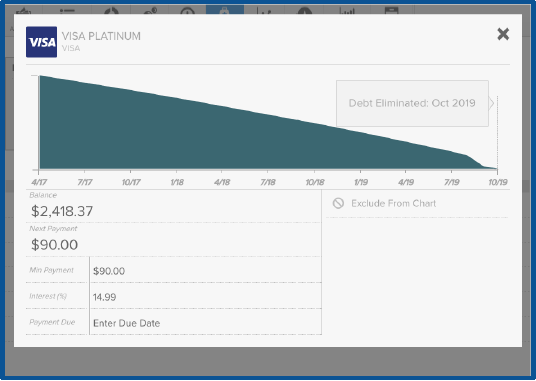

Loan Details

In order to cut down debt, it’s important to know what your payoff is. Payoff dates and the amount you save are automatically calculated based on your debt balance, interest rate, and minimum payment. Details like this can be entered manually. Click on any debt in your list to view the details of a loan in order to manually add the minimum payment and interest rate. You can also add the due date for a debt, if you would like to receive a reminder before the payment is due.

Debt Snowball Strategy

Through Money Management, you’ll be able to develop a strategy on paying down loans and debt. The debt snowball strategy allows users to expedite their debt reduction without increasing the monthly contribution toward debt. To follow the debt snowball strategy, you should “roll over” your monthly minimum payments as each debt is fully repaid. This will help you get out of debt faster, without the need for painful budget cuts.

Debt Priority Options

How have you chosen to manage debt? There are a few ways to manage your debt. Let’s say you don’t want to use the “Fastest Payoff First method. You can set your priority details to “Highest Interest First”, “Lowest Balance First”, or “Highest Balance First” by clicking on the drop-down menu below the navigation bar.

First Payoff First: Your debts will be ordered by which debt you will pay off soonest, based on balance, APR, and minimum payment.

Highest Interest First: Debts are ordered from your highest APR to the lowest APR.

Lowest Balance First: Debts are ordered by balance lowest to highest.

Highest Balance First: Debts are ordered by balance from highest to lowest.

Do you have some extra money to go towards your debt?

You may be curious as to what putting extra money toward your debt will do to your financial portfolio. In order to do that, you can click on “Total Monthly Paydown” and enter in the additional amount in the “Extra Payment Toward Debt” box. The graph will adjust to your setting to show how much you could save by putting extra money toward your debt.

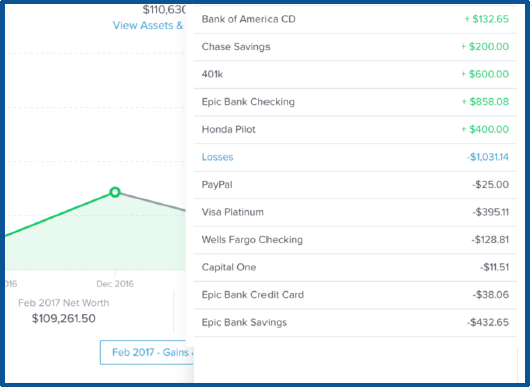

Net Worth

After calculating your debt and decreasing some of it, you’ll want to know where you stand in terms of finances. This would be considered finding your net worth. The Net Worth tab of Money Management tracks the sum of all of your assets and liabilities. Property Accounts can be added manually on the Accounts tab to account for key assets, such as the value of your home or vehicle.

There is a graph that details what your net worth is each month. As you click on each circle on the graph, it will tell you how your net worth increased or decreased. A sidebar will appear, showing the gains and losses within each account during that month.

Gains: An increased asset or decreased liability. For example, putting money in savings or making a car payment. This increases your net worth.

Losses: A decreased asset or increased liability. For example, pulling money out of saving or spending more on a credit card than you can immediately pay off. This decreases net worth.

You can choose to view the past 6,9, or 12 months of net worth history.

So what does this all mean? In order to be on the way to healthy finances, it’s important to take the time to do a health check on what you owe, how much you owe, who you owe, and how you can increase your net worth.

How does this benefit you? You’ll be on track to paying down debt faster than before and becoming more financially stable.

RELATED: Paperless Budgeting & Trending

Want more credit union information?

Subscribe to eNews